Round Up Feature

What is the "Round Up" feature?

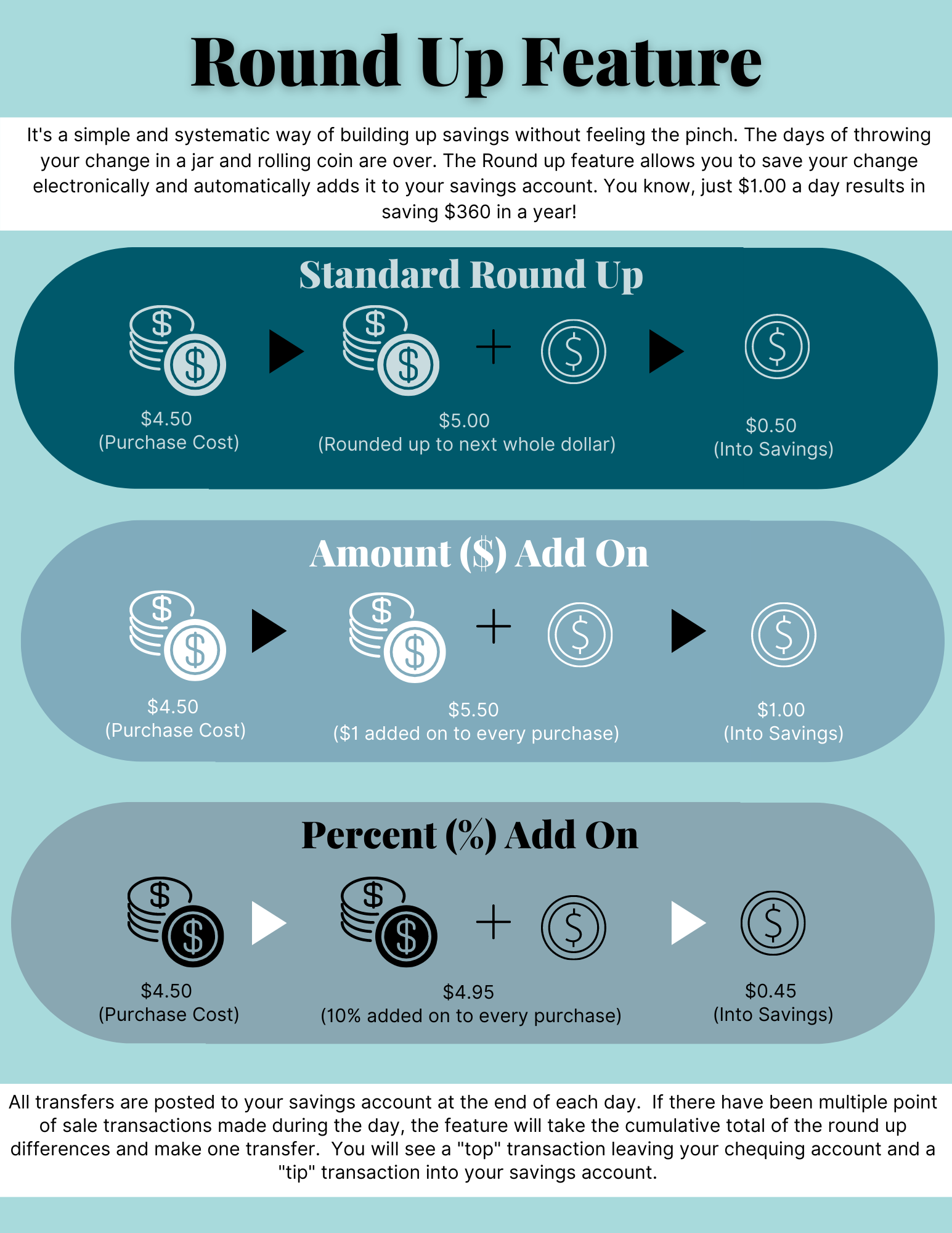

What are my options?

1. Standard Round Up: Your point of sale purchase is rounded up to the next whole dollar and transferred into your saving account each time your make a point of sale purchase with your debit card. For example, if you buy a coffee for $4.50, $5.00 is debited from your chequing account - $4.50 goes to the retailer for your coffee and .50 cents goes into your savings account automatically.

2. Amount ($) Add On - A fixed dollar amount of your choice will be transferred into your savings each time you make a point of sale purchase with your debit card. For example, if you buy a coffee for $4.50 and have chosen $1.00 add on per transaction - $5.50 is debited from your chequing account - $4.50 goes to the retailer for your coffee and $1.00 goes into your savings account automatically.

3. Percent (%) Add On - A fixed percentage of your choice will be transferred into your savings each time you make a point of sale purchase with your debit card. For example, if you buy a coffer for $4.50 and have choosen 10% add on per transaction - $4.95 is debited from your chequing account - $4.50 goes to the retailer for your coffee and .45 cents goes into your savings account automatically.

How do I arrange to get "Round Up"?

Simply come in or call your local branch and we'll set you up to start saving. It's that easy!

What if I want to save more money?

If you have specific savings goals, you may consider setting up automatic savings plans to help you reach your goals. Automatic, regular contributions are and effective way to save. There are many options available to help you contribute to a savings or investment plan. Use our calculators and tools to help you discover what it will take to reach your savings goals. Contact us to help you build an effective savings plan.