It’s a simple and systematic way of building up savings without feeling the pinch. The days of throwing your change in a jar and rolling coin are over. The Round up feature allows you to save your change electronically and automatically adds it to your savings account. You know, just $1.00 a day results in saving $360 in a year!

All transfers are posted to your savings account at the end of the day. If there have been multiple point of sale transactions made during the day, the feature will take the cumulative total of the round up differences and make one transfer. You will see a “top” transaction leaving your chequing account and a “tip” transaction into your savings account.

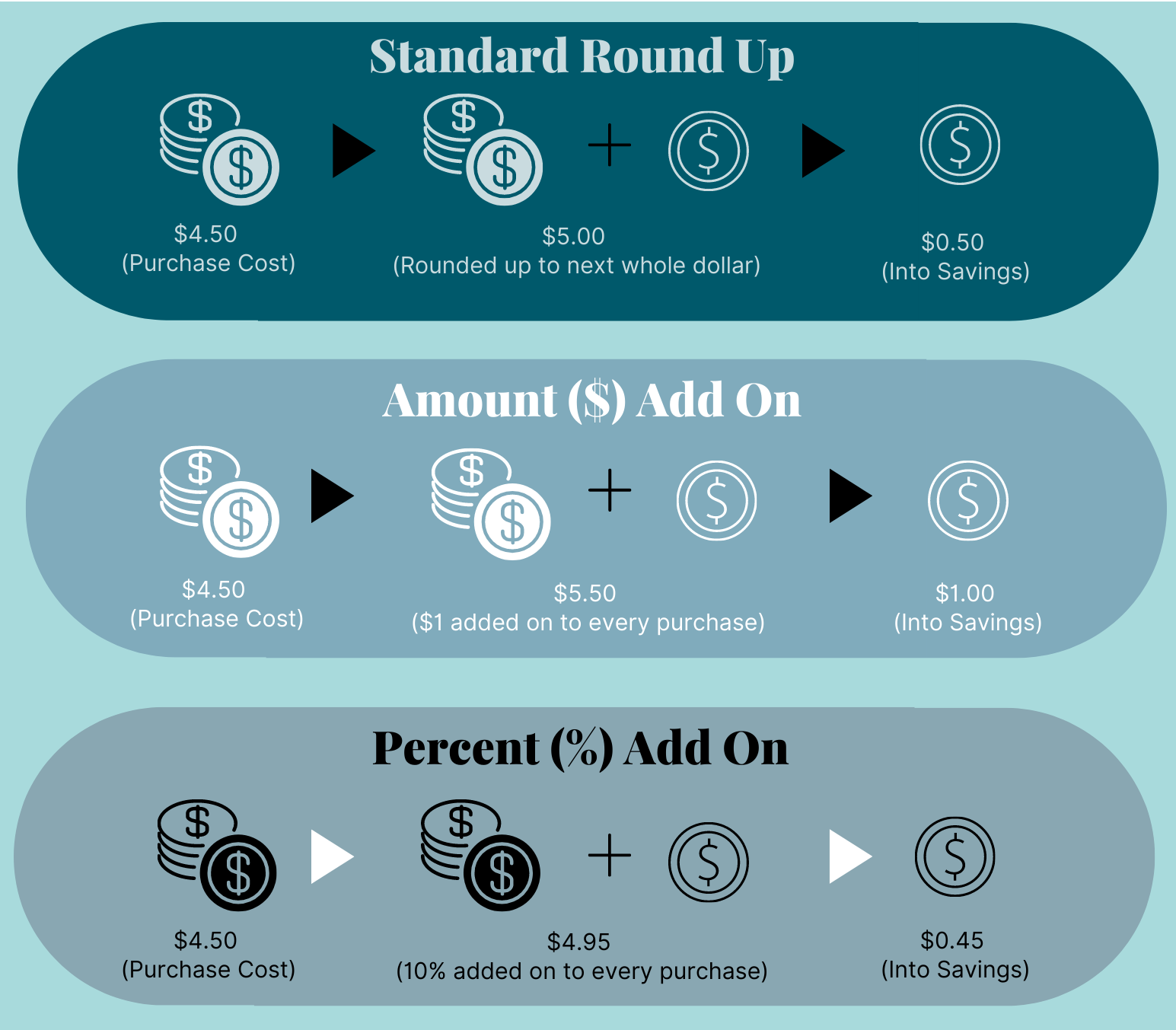

1. Standard Round Up: Your point of sale purchase is rounded up to the next whole dollar and transferred into your saving account each time your make a point of sale purchase with your KCCU Member Card® debit card. For example, if you buy a coffee for $4.50, $5.00 is debited from your chequing account – $4.50 goes to the retailer for your coffee and .50 cents goes into your savings account automatically.

2. Amount ($) Add On: A fixed dollar amount of your choice will be transferred into your savings each time you make a point of sale purchase with your KCCU Member Card® debit card. For example, if you buy a coffee for $4.50 and have chosen $1.00 add on per transaction – $5.50 is debited from your chequing account – $4.50 goes to the retailer for your coffee and $1.00 goes into your savings account automatically.

3. Percent (%) Add On: A fixed percentage of your choice will be transferred into your savings each time you make a point of sale purchase with your KCCU Member Card® debit card. For example, if you buy a coffer for $4.50 and have chosen 10% add on per transaction – $4.95 is debited from your chequing account – $4.50 goes to the retailer for your coffee and .45 cents goes into your savings account automatically.

Simply come in or call your local branch and we’ll set you up to start saving. It’s that easy!

If you have specific savings goals, you may consider setting up automatic savings plans to help you reach your goals. Automatic, regular contributions are and effective way to save. There are many options available to help you contribute to customized savings plan build for you.

® MEMBER CARD & Design are registered certification marks owned by Canadian Credit Union Association, used under license.

A third party is an individual or entity, other than the account holder or those authorized to give instructions about the account, who directs what happens with the account. For example, if an account were opened in one individual’s name for deposits that are directed by someone else, the other person or entity would be a third party.