At Kingston Community Credit Union, we offer more than the products and services you would expect from a financial institution, we provide cooperative banking where profits have a higher purpose. We invest in the economic development of our community by keeping money local and investing it back into Kingston and the people who live here.

Align your money with your values by banking with KCCU. In doing so you make good decisions for yourself while also improving the lives of others in our community.

Save money with our low and no fee account options.

5 Year Fixed Rate Mortgage

4.55

GIC/RSP/RIF/TFSA/FHSA

18 month

3.10

Green Loans as Low as

4.95% (var. OAC)

We are committed to helping develop strong money management skills. Check out our great library of learning resources.

We help our members do more by investing in our community through programs, initiatives and sponsorship activities.

2-Step Verification offers an additional layer of enhanced security to your online banking experience. This simple verification of your identity through a personal device will boost access control and create a more secure login.

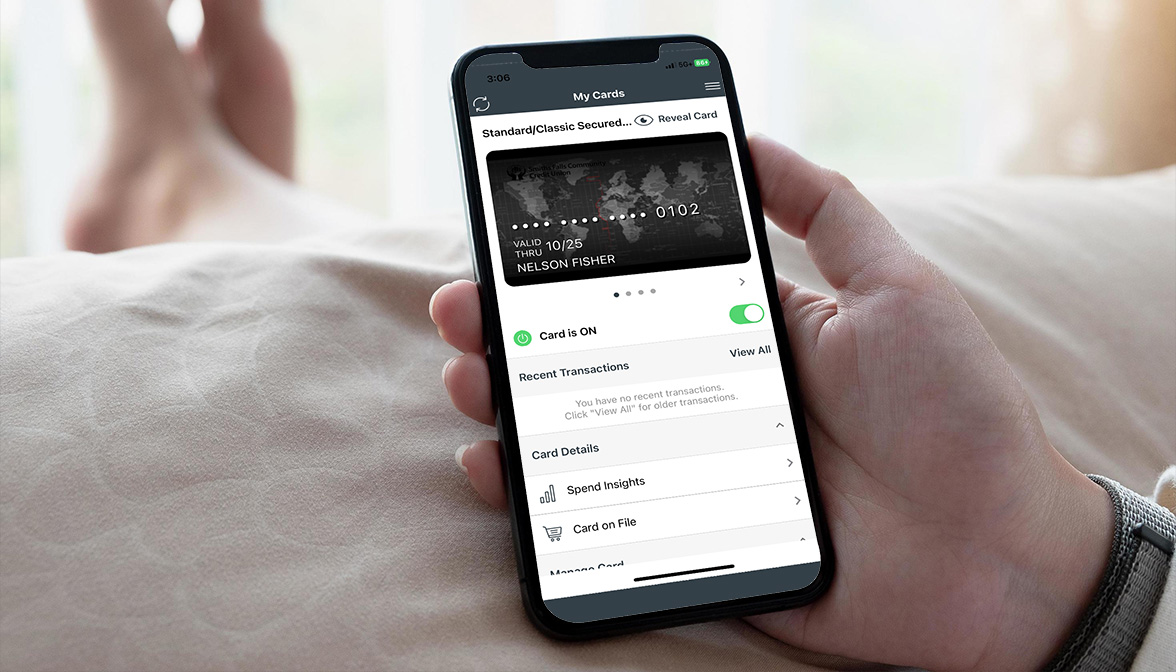

CardWise is the new way to manage your Kingston Community Credit Union credit card with security and ease. Use the mobile app or online platform to view your balance, customize transaction alerts and controls, block merchants, and more – all in one place.

As our member, you can enjoy exclusive savings – up to 55% – when you bundle your Home and Auto coverage with CUMIS, our loyal insurance partner.

Rewards are waiting with a card that fits your lifestyle. With your Cash Back World Elite® Mastercard, earning rewards is as simple and flexible as redeeming them. Apply today and start earning on everyday purchases.

At Kingston Community Credit Union, eligible deposits in registered accounts have unlimited coverage through the Financial Services Regulatory Authority (FSRA). Eligible deposits (not in registered accounts) are insured up to $250,000 through FSRA.

Kingston Community Credit Union is a credit union and not a bank. We often use the terms “bank, “banking” or “Banker” in our marketing materials, as we offer financial products and services. We want our members and visitors to this site to be aware of this distinction. Kingston Community Credit Union is authorized and regulated to operate in Ontario.

A third party is an individual or entity, other than the account holder or those authorized to give instructions about the account, who directs what happens with the account. For example, if an account were opened in one individual’s name for deposits that are directed by someone else, the other person or entity would be a third party.