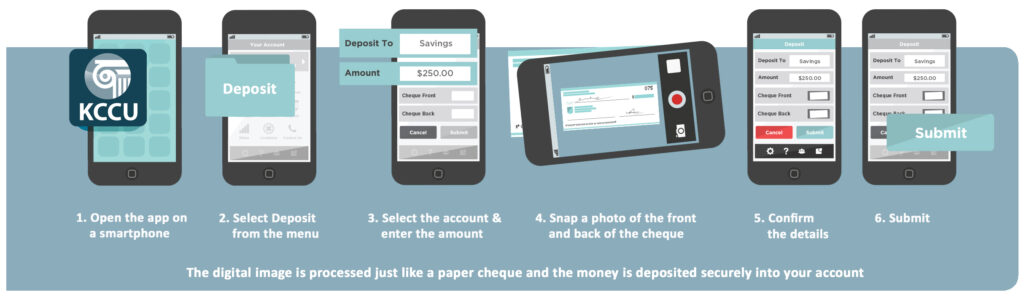

Deposit Anywhere™ is your new time-saving mobile app feature that allows you to remotely deposit a cheque using your mobile device, anytime of the day or night, without visiting a branch. It is available to all members that have KCCU Online Banking and have downloaded the KCCU Mobile Banking app on either an Apple or an Android phone or tablet.

Deposit Anywhere™ allows you to take a picture of your cheque and have it automatically deposited into your Kingston Community Credit Union account. There is no need to bring the cheque into the branch, unless requested to do so.

Please mark the cheque as “DEPOSITED” and file it away for now.

It is recommended that you hold onto the cheque for 90 days. After the 90 days, and once confirmed that the cheque has been deposited into your account, the cheque can be destroyed. This is in case there are any issues with the deposit that need to be checked.

In the rare circumstance that there is an issue with the deposit after you receive your confirmation, you will be contacted by us and may need to bring in the cheque.

No. Once you have submitted the cheque using Deposit Anywhere, you do not need to send them to the branch.

The cheque will automatically be deposited into your account but there may be holds in place.

Holds are in place on any cheque deposited through the mobile app for 3 business days. Please call your branch if you have any questions on this.

No, this is part of the services we offer with our KCCU Mobile Banking App.

There are methods for KCCU to determine if a cheque has been deposited more than once. The second cheque deposit will be reversed from your account. If you suspect that you may have deposited the same cheque twice, please contact your branch right away to resolve the issue.

You may deposit your cheque into a chequing or savings account that you already have set up on your account. You may not deposit the cheque into any registered products (TFSA, RRSP, RRIF), lending products (loans, lines of credit or mortgages) or your Dividend Savings or Equity account.

Yes, you can only deposit cheques that are in Canadian funds and drawn on a Canadian financial institution. They must be payable to, and endorsed by, the account holder. This includes cheques, money orders, bank drafts, convenience cheques and certified cheques.

No, only Canadian cheques (in Canadian funds) may be deposited using Deposit Anywhere. Any other cheque will have to be brought into the branch.

The software matches the number amount on the cheque with the amount you entered when depositing. If it reads that they do not match, it will give you that message and allow you to correct the amount. If the amount is correct,

then the software may be having a hard time reading the amount on the cheque. If this is the case, you will have to bring it in to a branch to be deposited. Sorry.

Yes. As a feature of our KCCU Mobile Banking App, Deposit Anywhere meets the same high standards as our mobile and online banking services.

® MEMBER CARD & Design are registered certification marks owned by Canadian Credit Union Association, used under license.

A third party is an individual or entity, other than the account holder or those authorized to give instructions about the account, who directs what happens with the account. For example, if an account were opened in one individual’s name for deposits that are directed by someone else, the other person or entity would be a third party.