Re: High interest rates and what you can (and likely should) do about it.

Dear Member/Borrower,

First, let me thank you for being a member of Kingston Community Credit Union, Kingston’s only local financial institution, serving the greater Kingston community and surrounding areas since 1957.

Your credit union serves its members as more than a financial institution but as a trusted partner in our financial lives and in our community. The credit union operates for all members and one of its primary duties is to represent them, their families, and their community’s best interests.

Though profitability is important to build our future together and to enable us to provide services at competitive prices, our main goal is to maximize member benefits, collectively and individually.

As many of us are aware, the Bank of Canada has used its tools to fight inflation. The most obvious impact they have is through the central bank’s interest rate-setting policies.

Since the early 2022, the Bank of Canada increased its rate to a peak of 5%. We have seen a decreasing trend starting in June of 2024 but many of us are still adjusting to higher rates than what we started out with before 2022 and we are concerned about what to do when our mortgages renew with much higher payments. Higher interest rates may cool down inflation but it impacts members who borrow more directly by increasing interest costs. Variable-rate credit products such as variable personal loans, lines of credit, home equity lines, and variable-rate mortgages are all affected by this. Banks and financial institutions determine their “prime rate” based on the Bank of Canada and KCCU is no exception.

To give borrowers an idea of the impact, we need to look at what a “blended” payment is. A “blended” payment is a payment determined at the time the loan is granted that determines how long it takes to be paid off (the amortization).

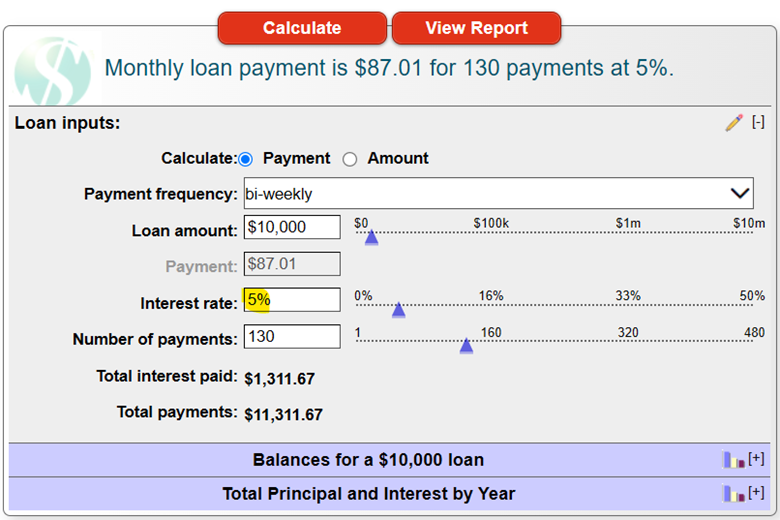

For example, if you took out a loan for $10,000 at 5% over 5 years, assuming all insurances and fees were included in that amount, the details of your loan calculations are outlined below in the first example.

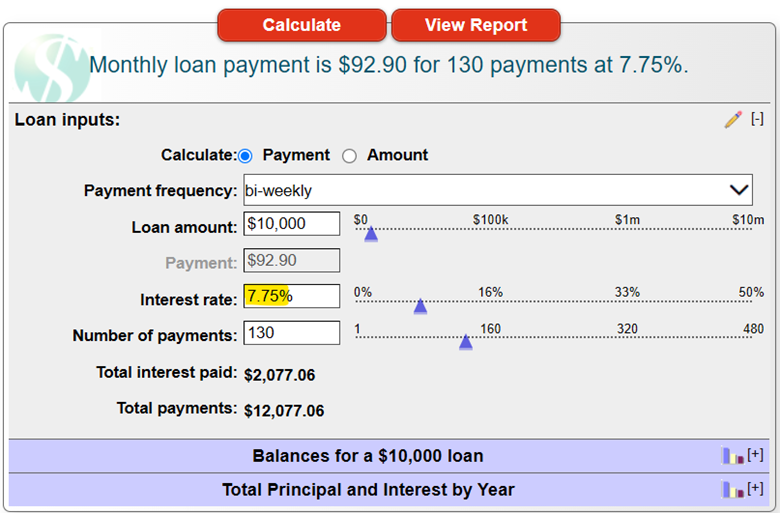

If you change the rate to take into consideration the increases in the Bank of Canada rate and recalculated at 7.75% (5% original rate plus as an example, an increase of 2.75%), you will see that you either have to increase your payment to pay the loan off over 5 years (130 biweekly periods) or accept that the loan will take longer to pay off.

That is because the interest portion of the blended payment is higher, so the amount that pays down the original principal is a lower portion of the original payment.

The difference per $10,000 is $92.90 (the new payment which pays off the loan over 5 years at the rate of 7.75%) less $87.01 (the original payment determined at 5%). This represents $5.89 more needed for every payment to stay on track and have the loan paid out in 5 years as originally intended.

No big deal!? Well…. If that was $100,000 that would be an increased payment of $58.90 every two weeks. On $300,000 that’s another $58.90 x 3 = $176.70 every two weeks – So the impact increases the larger the loan.

So, what are my options?

The thing to take into consideration is that in a fixed-rate mortgage or fixed-rate loan, your payment and amortization only change when it’s time to renew. So, it’s a good idea to talk to your lender and bring all of your debts together into the lowest-cost option. Credit cards, payday loans, and other higher interest rate debts need to be combined as much as possible to ensure your interest charges are as low as they can be while ensuring you are out of debt in a timeframe (over an amortization) YOU control.

If you renew your mortgage, KCCU lenders will offer you options to help you control the level of your payment. Bear in mind, you cannot exceed a 25-year amortization on a mortgage renewal, and you cannot exceed a 5-year amortization on a loan renewal (in most cases). One thing is certain, knowledge is power, and we are here to help.

I strongly urge you to use our loan amortization calculator below, entering your own loan details and viewing the results. This will help you to see what you are comfortable with and to ensure your monthly budget can adjust to higher lending costs. As always KCCU is here to help, and we are providing this information so you can make the best decisions for you and your family.

Contact us to arrange an appointment with one of our experienced lender. We can help you to understand your options and will help you find ways to reduce interest costs or discussing other options which can save you money.

Co-operatively Yours,

David S. Bull,

CFO / Credit Manager

How do I get started?

Use our Amortizing Loan Calculator and enter your own loan details to view the results. Try various scenarios to see what works best for your budget and needs.

Please contact if you would like to discuss further.

A third party is an individual or entity, other than the account holder or those authorized to give instructions about the account, who directs what happens with the account. For example, if an account were opened in one individual’s name for deposits that are directed by someone else, the other person or entity would be a third party.