A Registered Retirement Savings Plan (RRSP) is a savings plan that is registered with the federal government and available to most Canadians allowing tax-deferred investment.

Canadians are living longer and more active lifestyles in retirement. RRSPs can be an important part of your overall retirement plan, helping you to maintain your standard of living when you retire.

An RRSP can hold a combination of eligible investments, such as mutual funds, stocks, bonds and ETFs *, Guaranteed Investment Certificates (GICs) and cash.

Whether you are starting your first job, starting a family, or during your peak earning years, RRSPs play an important role in your long term financial goal. No matter what stage of life you are in, KCCU can help you make the most of your allowable RRSP contributions.

RRSP deposits reduce your annual taxable income by the amount of the eligible contribution, lowering the tax you pay so you can keep more in your pocket. The amount you contribute to your RRSP is claimed as a tax deduction, therefore reducing your “earned income” and saving you income tax.

Your investments grow, tax deferred, while invested in the RRSP. The money you earn on your contributions stay in your RRSP. You don’t pay tax on it until you take it out of the plan. It is an ideal way to harness the power of compound interest and supplement your retirement income. This is beneficial to those of us who will earn less in retirement than we do working today.

Income splitting can be achieved through a spousal RRSP which allows the higher income earning spouse to contribute to an RRSP in their spouse’s name. This helps even out retirement income and lowers your combined taxes both now and in retirement.

You are able to borrow from your RRSP for some of life’s major events such as buying your first home through the Home Buyers Plan or pursing an education using the Life Long Learning Plan .

An RRSP is not meant to be a short term or temporary investment. However, you may withdraw all or part of your investment at any time*. RRSP withdrawals are subject to tax and the terms of the investment in the plan. Withholding taxes apply on funds withdrawn from an RRSP except when the funds are being transferred from one RRSP top another, or when being transferred into a Registered Retirement Income Fund (RRIF).

*There are withdrawal restrictions that will apply to locked-in RRSP plans.

There are two scenarios that permit you to withdraw funds from your RRSP without incurring income tax: buying a qualifying homer or going back to school. The Home Buyers Plan (HBP) allows you to withdraw up to $25,000 from your RRSP investment for the purchase of a qualifying home. The amount you withdraw must be repaid (replaced in your investment) within 15 years; subject to a minimum annual repayment that is 1/15th of the amount withdrawn.

If you are going back to school, the Lifelong Learning Plan (LLP) allows you to withdraw up to $20,000 from your RRSP investment to pay for eligible training or education for you, your spouse or your common law partner. Once you withdraw the funds, you have 10 years to repay the money.

When you are ready to start withdrawing funds from you RRSP investment, or by the end of the year in which you turn 71 (whichever comes first), you must convert your RRSP into a Registered Retirement Income Fund (RRIF). With a RRIF, your investment can continue to grow on a tax-deferred basis but you are required to withdrawal at least a minimum amount each year. You may choose to increase the amount or the frequency you receive funds from your investment, as long as the minimum is withdrawn. (Please note, locked-in plans have specific restrictions, please contact one of our Investment Specialists to learn more).

If you simply withdraw the money from your RRSP investment, you will have to pay the withholding tax on it and the money withdrawn will be classified as income for you in that taxation year. Depending on your income level, you may still be required to pay income tax on this amount on top of what was already paid with the withholding tax.

While you can contribute to your RRSPs at any time during the year, you only have 60 days into the New Year; until March 1st (or February 29th during a leap year); to have the deposit be deducted from your income for the prior tax year, current year or future year(s). Once this date has passed, any contributions made can be applied to the current year’s income (or subsequent year’s income).

You are able to contribute each year up to December 31st in the year in which you turn 71. After that date, you may not make further deposits to your RRSP and it must be withdrawn or converted in to a RRIF.

(Please note: when the deadline falls on a weekend, the Canada Revenue Agency (CRA) may extend the deadline to the following Monday).

After filing your taxes last year, you received a Notice of Assessment from the Canada Revenue Agency (CRA), stating your maximum contribution for the current year. To get your contribution room, visit the CRA’s website by clicking here, or call their TIPS hotline at 1-800-267-6999.

The amount you are allowed to contribute is determined by the “earned income” you report on your tax return. It is 18% of your previous year’s “earned income”, up to an annual limit. Each year, the annual limit set by the government changes. To find out the limit for this year, please visit the CRA Website.

This limit may be reduced if you belong to a pension or deferred profit sharing plan through your employer (refer to your T4 slip). It can also be increased if you do not contribute the full allowable amount in the previous year or years.

If you go over the limit, you are penalized 1% a month on the excess amount. Although, up to $2,000 may be over-contributed during your lifetime without penalty. To be safe, it is always better to check with CRA or your Notice of Assessment to confirm your annual contribution limit.

If you do not make your maximum annual RRSP contribution, any unused portion is automatically brought forward, so you can use it in future year(s).

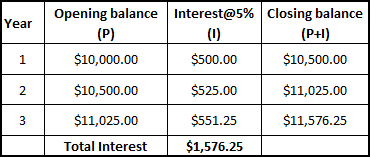

The sooner the better. Interest in an RRSP investment is compounded, so the interest you earn is re-invested. You earn interest on the principal and the reinvested interest. The earlier you make the deposit; or the sooner you can start making deposits; the sooner you can take advantage of the power of compound interest and the more your investment will grow.

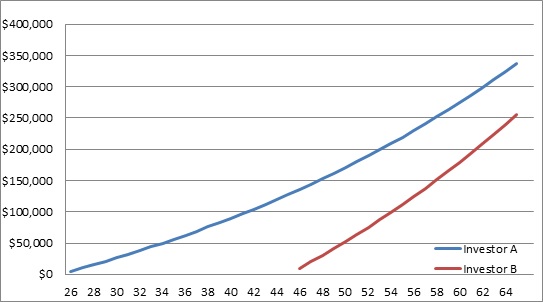

We have two friends who are looking to invest in an RRSP; Jennifer (Investor A) and Josh (Investor B). Jennifer decides to start investing $5,000 each year in an RRSP that has interest of 2.5%* compounded annually and continues with this same amount up to age 65 (40 years of investing). Josh on the other hand, decides to hold off a little while and waits to start until age 46 and then continues to age 65 (20 years investing). Since Josh knows there is only half the amount of time left compared to Jennifer to invest until reaching the age of 65, he decides to double the investment amount to $10,000 each year at the same interest rate; 2.5%* compounded annually.

As seen in the illustration, even though both Jennifer and Josh each contributed $200,000, Jennifer`s investment portfolio is over $81,000 higher than Josh`s, all because she started earlier and gave the money longer to grow with compound interest.

If you are no longer 26 years of age, the point is not that you shouldn`t invest in RRSP`s, it is that you should start investing now in your RRSP. This will allow the compound interest more time to work for you and give you more money at your retirement. The earlier you invest, the more your investment will grow.

*Interest rates vary depending on different factors, including type of investment and the investment term (length). This example assumes an average interest rate of 2.5%.

Any Canadian up until the age of 71 who earns income and/or still has contribution room available may contribute to an RRSP. Even if you are not taxable, you should file a tax return to report your earned income and create RRSP contribution room.

Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. It means, over the course of your investment, you will earn interest on the interest you have earned in previous years, as well as on the principal deposited. This causes the investment to grow much faster.

*Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. Commissions, trailing commissions, management fees, and expenses may all be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds, other securities, and cash balances are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer that insures deposits in credit unions. Mutual funds and other securities are not guaranteed, their values change frequently and past performance may not be repeated.

At Kingston Community Credit Union, eligible deposits in registered accounts have unlimited coverage through the Financial Services Regulatory Authority (FSRA). Eligible deposits (not in registered accounts) are insured up to $250,000 through FSRA.

A third party is an individual or entity, other than the account holder or those authorized to give instructions about the account, who directs what happens with the account. For example, if an account were opened in one individual’s name for deposits that are directed by someone else, the other person or entity would be a third party.