We are currently experiencing technical difficulties with e-transfer money requests in both the KCCU Mobile Banking App and Online Banking. Our team is actively working to resolve the issue, and we apologize for any inconvenience this may cause.

Status: Resolved

Canada Post employees have begun a strike as of September 25, 2025, and will remain on strike until a new agreement is reached. At this time, there is no set end date for the strike.

This disruption may affect the delivery of your KCCU account statements and other important documents sent by mail. To ensure you stay updated with your KCCU accounts, we encourage you to sign up for e-statements.

Why choose e-statements?

E-statements are available at no cost to members who have online banking. You can easily download your monthly statement directly from online banking and can opt to receive an email notification each month when your e-statement is available.

How to view your e-statements:

Need a paper statement?

You can request a paper statement by visiting one of our three KCCU branches. A Member Services Representative will print your statement for you free of charge. We appreciate your understanding and encourage you to make the switch to e-statements for faster, more reliable access to your account information.

If you are currently not signed up for online banking but would like to be, please visit or call one of our branches.

Collabria Credit Cards

Collabria cardholders are still required to make at least the minimum monthly payment on their credit card accounts.

If you typically receive your statements by mail, there are other convenient ways to access your statements and make payments.

You can view your balance, transaction history and enroll in e-statements anytime at cardwiseonline.ca, or through the CardWise Mobile app. Additional information and how-to’s can be found here and at www.collabriacreditcards.ca/myaccount.

If you are not enrolled in one of the digital account management solutions available for your card, but wish to confirm your account balance, automated balance updates are available by calling the number on the back of your card. Once an active card number is entered, remain on the line to hear an automated balance summary.

Kingston Community Credit Union is committed to supporting you during the Canada Post service disruption. For assistance, contact any of our three branch locations, we’re here to help.

KCCU Branches & Phone Numbers

Click here to learn more about the Government of Canada and the delivery of your social benefit cheques.

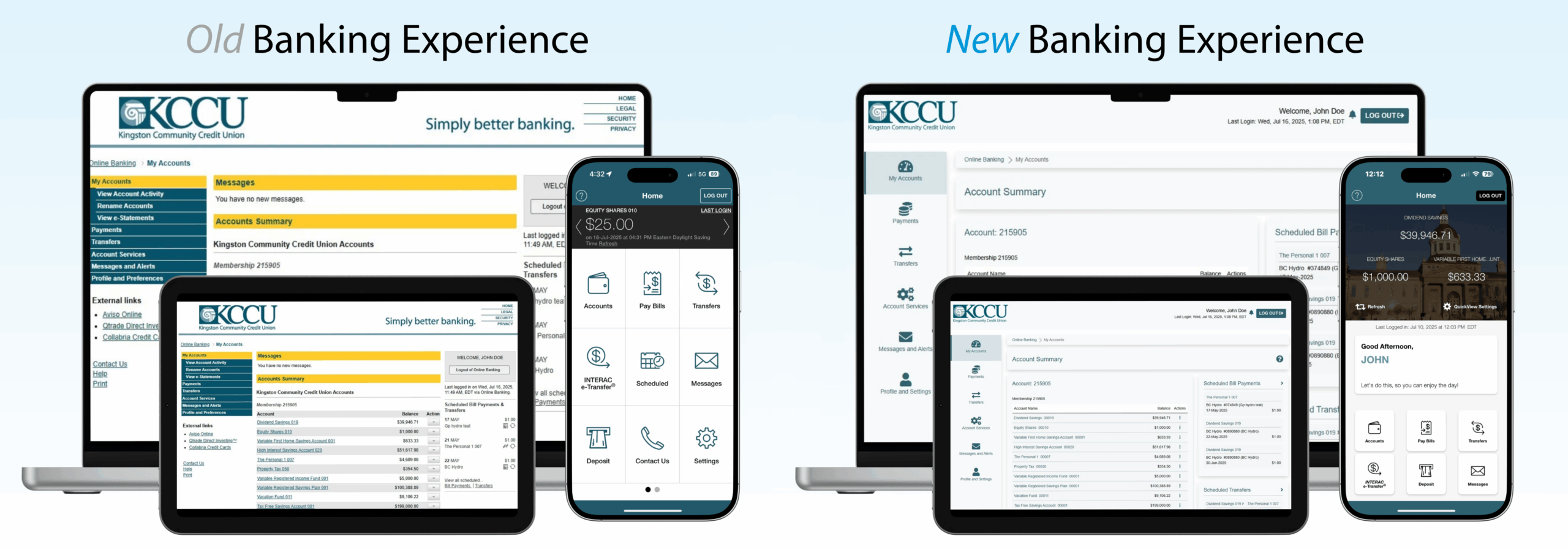

KCCU is excited to share that we’ve updated your online and mobile banking experience!

Your trusted banking tools just got better. Starting July 30th, 2025, you’ll notice a fresh new look when you log in to online banking or open the mobile app.

Our new app and online banking platform offer the same great features you rely on, now with a modern interface designed to make your experience smoother and more intuitive.

When will the changes to the online banking platform and mobile banking app be effective?

The online banking platform will be available to you on July 30th, 2025, in the early afternoon. Simply visit the KCCU website and click the orange “Log In” button in the top right corner.

The mobile banking app will be available to Apple and Android users on July 30th, 2025, in the early afternoon.

Will I need to update my mobile banking app?

Your device may be set up for automatic updates, which will automatically update your app to the new platform. If you do not have automatic updates set up you will be required to manually update the app within your device settings.

Please note that all mobile banking apps must be updated to the newest version by August 6th, 2025. You will need to update your app to continue using it. Access may be restricted until the app update is complete.

Will my online banking link that I have bookmarked still work?

If your login page is bookmarked, you’ll need to go to the KCCU homepage, click the orange “Log In” button in the top right corner, and re-save it to your bookmarks/favorites within your browser.

Will my login information change?

Your login credentials will remain the same for the updated mobile app and online banking platform, you can continue using the same username and password as before.

However, when you access the new version for the first time, you may need to reconfigure certain security settings. This could include setting up Face ID, saving login details, and reselecting your two-step verification (2SV) preferences.

What changes will I notice with the new mobile banking app and the online banking platform?

While the visuals are new, everything you rely on is still right where you need it. We’ve kept what works, and made it look even better!

All the features you count will still be available. However, you may notice updates to the appearance, placement, and color of certain navigation buttons and labels.

To help you get familiar with the new layout, the image below gives you a preview of how key information will appear when you log in to online banking.

I have set up bill payees, e-transfer recipients, and pre-authorized deposits, will there be any changes to these?

Rest assured your bill payees, e-transfer recipients, and pre-authorized deposits will remain unchanged. All your existing information and scheduled transactions will carry over seamlessly to the refreshed banking platform.

Tap Into Your Local Summer starts now!

From now until August 31, every time you use your KCCU Member Card® debit card in-store, you’re automatically entered to win one of twenty $1,000 prizes.

Shop local. Use your own money. Win something great. Read the full contest rules here.

® MEMBER CARD & Design are registered certification marks owned by Canadian Credit Union Association, used under license.

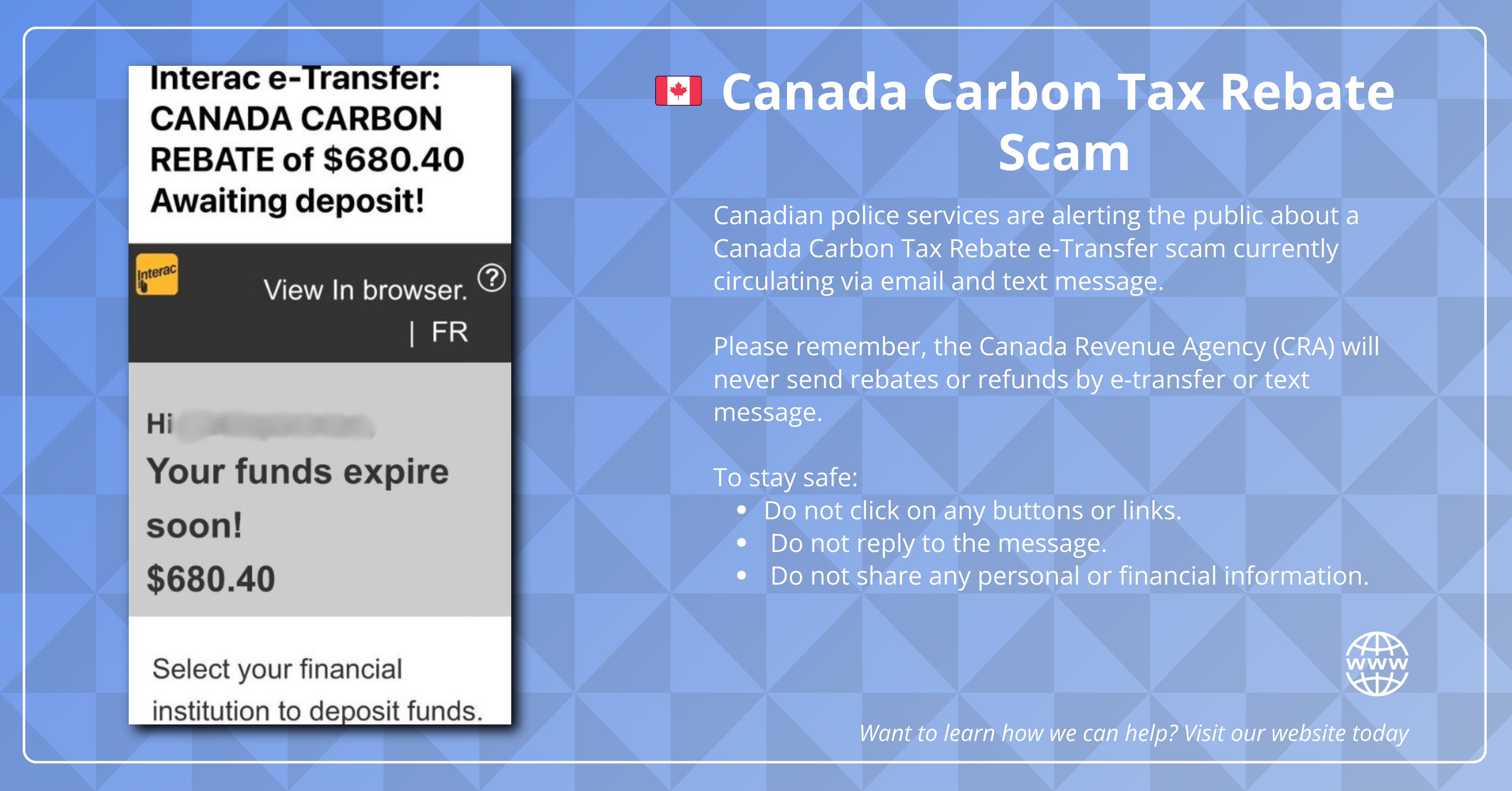

Canadian police services are alerting the public about a Canada Carbon Tax Rebate e-Transfer scam currently circulating via email and text message. This scam may involve look-alike domains and phishing websites designed to deceive recipients. Please note that this scam is likely to resurface periodically, particularly around the distribution dates for the Canada Carbon Tax Rebate which are:

A reminder that the Canada Revenue Agency (CRA) will never send rebates or refunds by e-transfer or text message. If you are unsure if an email or text message you have received is from a legitimate source please call your branch for assistance.

Members will be required to upgrade their mobile banking app on Tuesday, November 12th, 2024 through the Apple App Store and Google Play Store.

Please see the update to the Schedule of Fees as indicated in red in our Schedule of Fees document. Changes will take effect on November 30th, 2024.

Terms and Conditions have been updated on the the Debit Card / Personal Identification Number / Mobile Payment

Service Agreement. Details

Please see the update to the Schedule of Fees as indicated in red in our Schedule of Fees document. Changes will take effect on October 11, 2024.

Collabria Credit Card Holders: With the introduction of the new digital account manager CardWise, the MyCardInfo platform will retire for consumer personal credit cards on August19.

KCCU was not directly impacted by the world-wide Microsoft OS update.

An update to a security software used on many Microsoft system had a failure, preventing the Microsoft OS from rebooting properly. KCCU’s member banking services and systems were NOT impacted – KCCU banking, online banking, mobile banking and the three branch ATMs remained up and running normally.

Some member deposits and transfers to and from other institutions were delayed, as many of the financial institutions and networks at the other end of the transaction were impacted.

Please note that effective May 29, 2024, Kingston Community Credit Union will no

longer support the option to pay for online purchases directly using Interac®

Online Payments (IOP). This includes payments to retail merchants, as well as bill

payments such as Canada Revenue Agency (CRA) remittances.

Collabria has identified a suspicious website, collabriacreditcards.life, which appears to be a phishing site designed to capture Collabria cardholder details. We want to assure you that Collabria’s security team is actively working to address this risk and mitigate any potential harm to cardholders.

The faulty site currently being displayed is likley to be modified to closely resemble Collabria’s official website. The page description is identical to that of Collabria Financial. If you receive communication that refers to this website URL, do NOT click on it or take any action. Learn More.

Collabria has identified a suspicious website, collabriacreditcards.life, which appears to be a phishing site designed to capture Collabria cardholder details. We want to assure you that Collabria’s security team is actively working to address the risk and mitigate any potential harm to our cardholders.

The faulty site currently being displayed is likely to be modified to closely resemble Collabria’s official website. The page description is identical to that of Collabria Financial. If you receive communication that refers to this website URL, do NOT click on it or take any action.

Cardholder support team members work on your behalf 24/7 every day of the year.

To report a lost or stolen KCCU Collabria Mastercard®, please call: 1-855-341-4643

To report an issue or a lost or stolen KCCU Member Card® debit card, please call or visit your branch during business hours.

Outside of regular credit union hours, please call: 1-877-801-9516

® MEMBER CARD & MEMBER CARD Design are registered certification marks owned by Canadian Credit Union Association, used under license.

A third party is an individual or entity, other than the account holder or those authorized to give instructions about the account, who directs what happens with the account. For example, if an account were opened in one individual’s name for deposits that are directed by someone else, the other person or entity would be a third party.